Chapter 13 bankruptcy is also known as the wage earners plan as it offers individuals the opportunity to repay their debts by developing an ideal plan. Under the repayment plan created by the debtors, they have to pay the debts by making installments within three to 5 years.

Let’s take a dive into the process of Chapter 13.

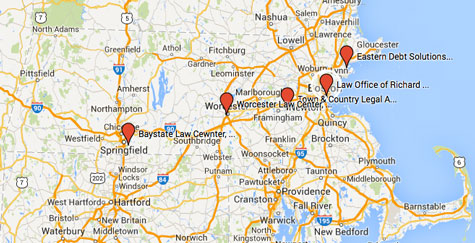

• The primary thing is to select an ideal chapter 13 bankruptcy attorney who can offer you free evaluation as well the estimation of filing chapter 13 and the fees charged.

• The applicant has to pay the filing fee to the court and miscellaneous administrative fees.

• The applicant also needs to provide the details including the list of creditors and their respective claims, a list that includes all the properties of debtor and leases in debtor’s name, breakdown of the sources of debtor’s income, entire monthly expenses of debtor, tax information including the recent tax return and the statement of unpaid taxes.

• After the filing procedure, the debtor proposes the repayment plan. The creditor can raise objections against the plan but the ultimate decision is taken by the judge by over viewing the repayment plan.